does nevada have an inheritance tax

Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased. Nevada - Notaries can charge 5 for taking an acknowledgement and 250 for each additional signer.

The Property Tax Inheritance Exclusion

It means that in most cases you wont be responsible for any tax due if you inherit property in Nevada.

. New Jersey Nebraska Iowa Kentucky and Pennsylvania. Just as others do on their wages. Nevada Inheritance Tax and Estate Tax.

Nevada - Notaries can charge 5 for taking an acknowledgement and 250 for each additional signer. Under Nevada law there are no inheritance or estate taxes. Inheritance tax is different from estate taxes which is also different from although related to the gift tax.

Nevada does not levy an inheritance tax. But taxes are just one element. Does Nevada Have an Inheritance Tax or Estate Tax.

There are two types of taxes possible on an inheritance but they are rare. In 2021 the first 117mil per individual is. NV does not have state inheritance tax.

Whether or not you will be required to pay an inheritance tax depends. Nevada - Notaries can charge 5 for taking an acknowledgement and 250 for each additional signer. Zero No Nevada State Income Tax.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. If inheritance tax is paid within three 3 months of the decedents. When it comes to estate tax there is a.

However an estate in Nevada is still subject to federal inheritance tax. There are 12 states that have an estate tax. However most states provide various exemptions from the transfer tax.

No Nevada Inheritance Tax after 3 years of residency. Theres No Franchise Tax. What Spouses Need to Know About.

The state of Nevada does not collect inheritance tax however federal taxation may also affect an inherited property even in Nevada. No Nevada does not apply an inheritance or estate tax. Since the state does not impose an estate or inheritance tax upon death less money is deducted during probate than if the property was located in any other state in.

If an inheritance tax exempted the. However estates valued above 1206 million in 2022 are subject to a federal estate tax. Theres No Corporate Income Tax.

It is one of the 38 states that does not apply an estate tax. Just five states apply an inheritance tax.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Nevada Income Tax Nv State Tax Calculator Community Tax

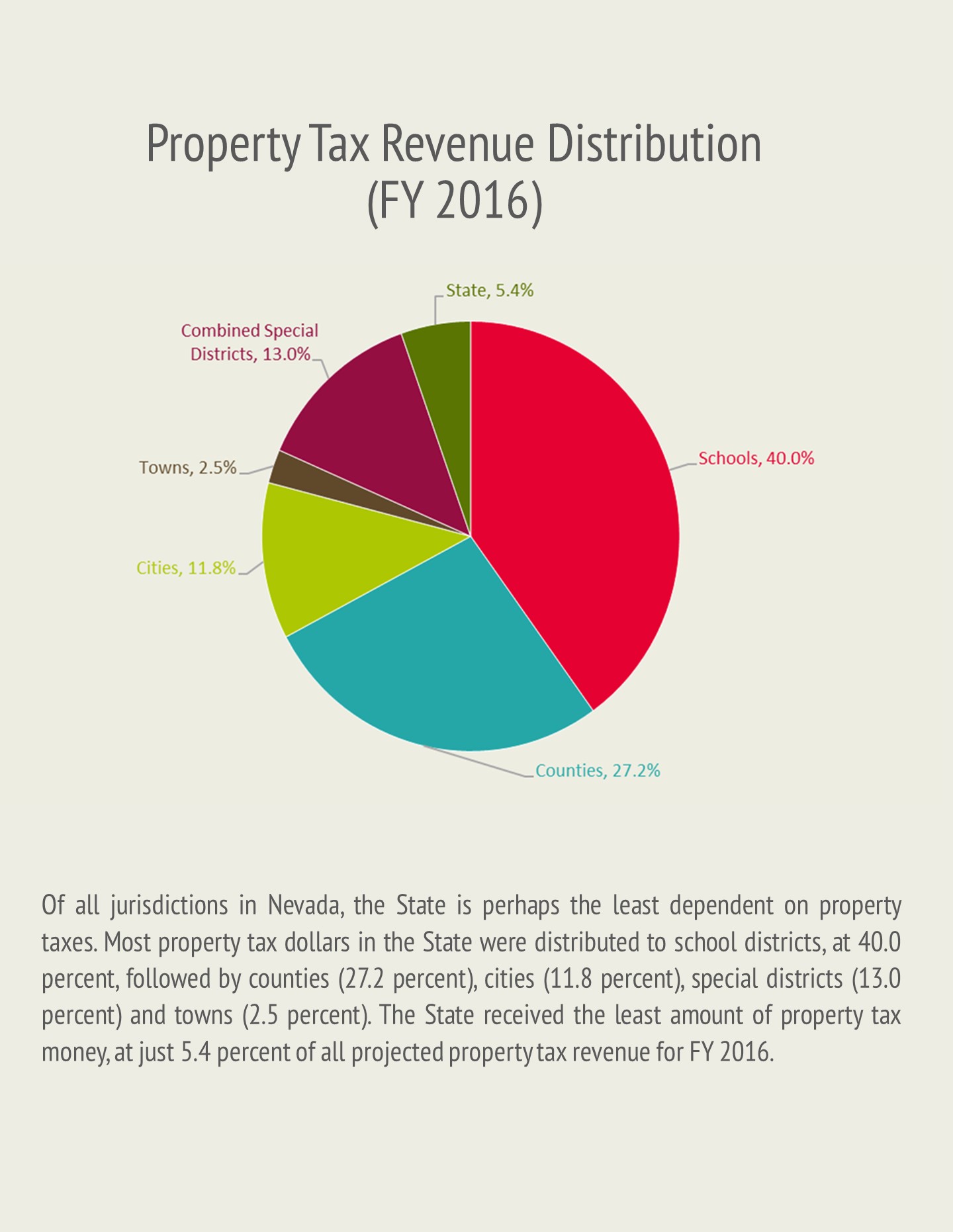

Property Taxes In Nevada Guinn Center For Policy Priorities

How Many People Pay The Estate Tax Tax Policy Center

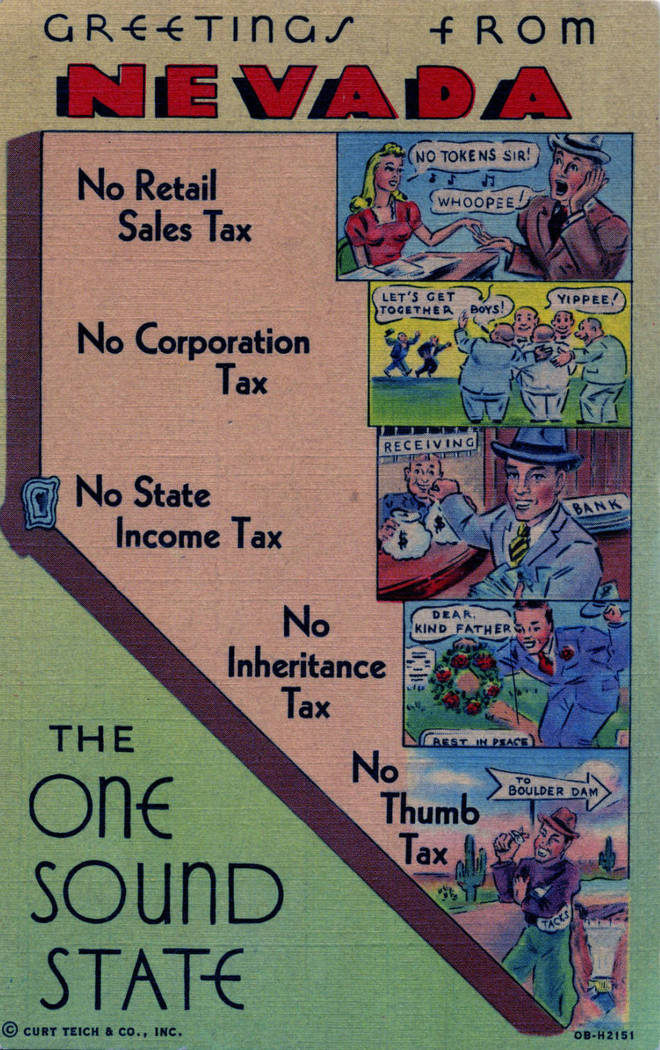

Greetings From Nevada Color Postcard For Business Promotion Reads No Retail Sales Tax No Corporation Tax No State Income Tax No Inheritance Tax No Thumb Tax The One Sound State

Nevada Last Will And Testament Legalzoom

Las Vegas Locally On Twitter Tbt To The Glory Days Of No Taxes At All In The Debt Free State Of Nevada Https T Co 88hngn5luk Twitter

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Estate Tax Everything You Need To Know Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

State By State Estate And Inheritance Tax Rates Everplans

Prince Will Pay Millions In Death Tax

Nevada Health Legal And End Of Life Resources Everplans

State Approves Tax Incentives For Google Lithium Company Amid Promise To Raise Threshold For Future Tax Breaks The Nevada Independent

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States That Do Not Tax Earned Income

Nevada State Line Highway Marker Road Sign 1947 Welcome Debt Free 15x10 Ebay

State Tax Collections Running Ahead Of Predictions Serving Minden Gardnerville And Carson Valley